How to Secure 20+ Qualified Investor Meetings In The Next 30 Days

WITHOUT Investor Marketing Agencies, Brokers, Or Oversaturated Platforms

See what founders have to say about Storm X.....

Startup Fundraising: How to Get 20+ Meetings With Investors Per Month Using Systemized Investor Relations

WITHOUT Investor Marketing Agencies, Brokers, Or Oversaturated Platforms

In the next couple of minutes I am going to be showing you how we have helped founders get from zero pitches to 5xing their investor engagement in less than 30 days using multi-channel investor relations.

This process was developed for founders who are tired of oversaturated platforms, investor brokers, or investor marketing agencies who over-promise and just email blast to random databases while taking huge retainers or percentages.

We are going to dive into all the aspects of a successful investor relations campaign and how to optimize each sector to get the highest engagement from qualified investors who actually give you the time of day.

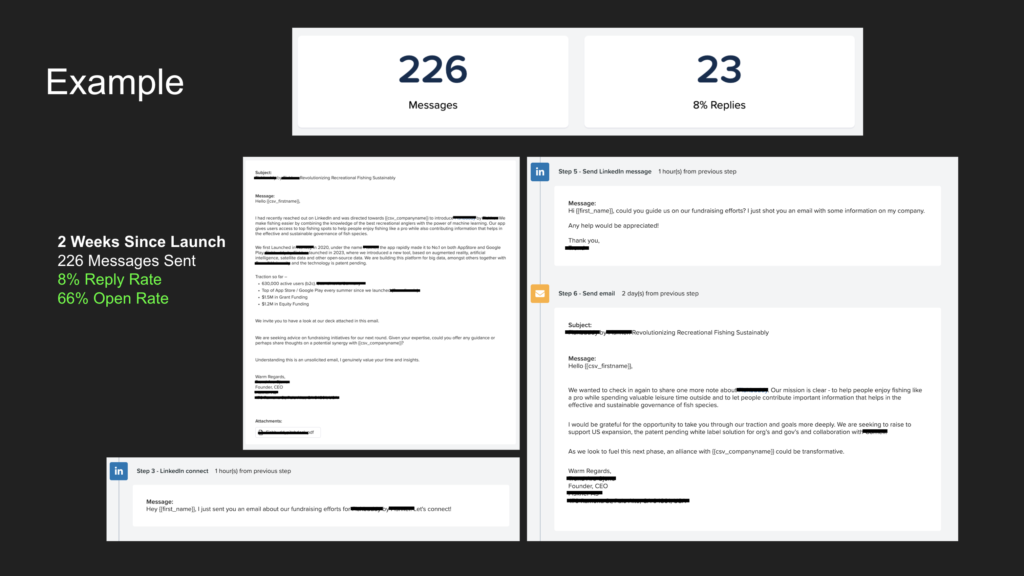

Case Study

To show this in action, here is a campaign we just launched a little more than a week ago for a company that already has a 8% reply rate and mostly positive responses from investors.

This campaign is utilizing the Storm X Investor Relations Manager so we were able to utilize LinkedIn and Email to optimize open rates and provide the most personalized experience for each investor we reached out to.

Even though not all replies are going to be positive, any reply is an opportunity to build a relationship that could ultimately get you a warm introduction.

Who is this for?

Whether you have had a successful raise before or are new to fundraising, all start-ups are facing the same challenges. The platforms used to raise capital are over saturated, investors are getting tired of constant pitch emails, and building a pipeline of investors is extremely time consuming.

This solution is for those who want to create a real impact on their fundraising efforts by doing things with a proper strategy built by expert marketers for founders.

This is for start-ups who want to stand out and have a steady stream of qualified investors so they can consistently pitch and refine their initiatives to quickly raise capital and grow their business.

How Do We Do it?

So how do we do this? Your goal is to start conversations with qualified investors who are going to give you the space to share information and eventually pitch. I am going to go over the 3 steps that create a successful investor relations campaign.

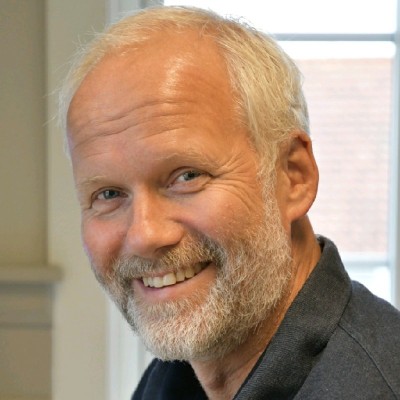

Who Am I?

Before we jump in, I’m Michael Mohammadi, CEO and Co-Founder of Storm X Capital, where we have helped start-up founders raise 100’s of thousands to millions of dollars using multi-channel investor relations.

Resulting in over $10,000,000 raised and over $25,000,000 currently being raised.

My Co-Founder and I merged his experience in start-up fundraising, with my experience in direct to consumer marketing and business development to create a system that values the fundamentals of fundraising while harnessing on the often overlooked, marketing and strategic side of outreach.

We aim to provide the most value to start-up founders who are looking to raise capital, not spend it on huge retainers for services that ultimately don’t work.

Now, let’s get to it.

Step 1: Where and How To Find Investors

To start, we need to identify the best individuals to target. When we see start-ups reaching out to investors, most of the time they are purchasing lists, using scraping tools, or subscribing to over saturated platforms that every other start-up is using. These are extremely ineffective because you are reaching out to random, unqualified people.

If you want that strategy to actually work, you would need to find lists of thousands of investors and pray that some are qualified, and that your emails won’t end up in the spam folders for those that are.

A lot of the companies that we work with come from marketing agencies that email blast proprietary databases of 1000’s of investors at a time. This results in a flood of negative responses, ruining of your email reputation, and a very poor first impression of your start-up.

What we recommend and do for our clients is provide a dedicated data researcher to hand-pick and qualify investor contacts so any outreach is only sent to qualified investors that can actually provide value, and have a much higher chance of responding.

Where do we find these contacts?

We use a variety of the most up-to-date sources including recent events, current investor groups, and any relevant sources depending on your industry.

Market research and data is extremely important and we find that when we collect anywhere between 300-500 hand-picked contacts, we are able to get up to 15% reply rates resulting in 45-60 new conversations with investors per month.

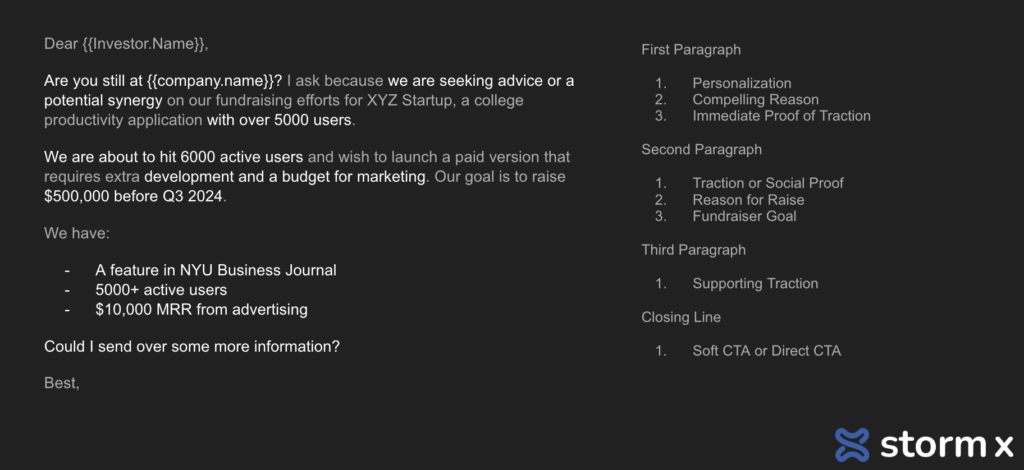

Step 2: What To Say To Investors

Once we do our research to identify who and where our ideal investors are, we have to take a look at the copy that is being sent.

Almost every time we look at a start-ups message to investors, we notice that it is usually a long email briefing the investor of every little detail of their business plan and investment opportunity.

You have to think, why would the investor care enough to read that email. That sounds harsh but we have to give an investor a reason to read the email and a reason to reply.

I like to say that copywriting is just giving the reader permission to read the next line. Are your emails doing that?

We had a blockchain company that launched their campaign with us and we didn’t see the best results in the first week so we changed the formatting of the email slightly by adjusting the call to action and switching one sentence. This slight change resulted in a surge of replies from investors asking her to send her pitch deck over.

The Copy matters. A lot.

We find that creating scripts with multiple personalized points and a soft call to action like asking for fundraising advice or guidance generates the best responses for our clients.

We don’t want this email to look like it is being sent to 1000 people and we want the reason we emailed to give the reader incentive to actually read the email.

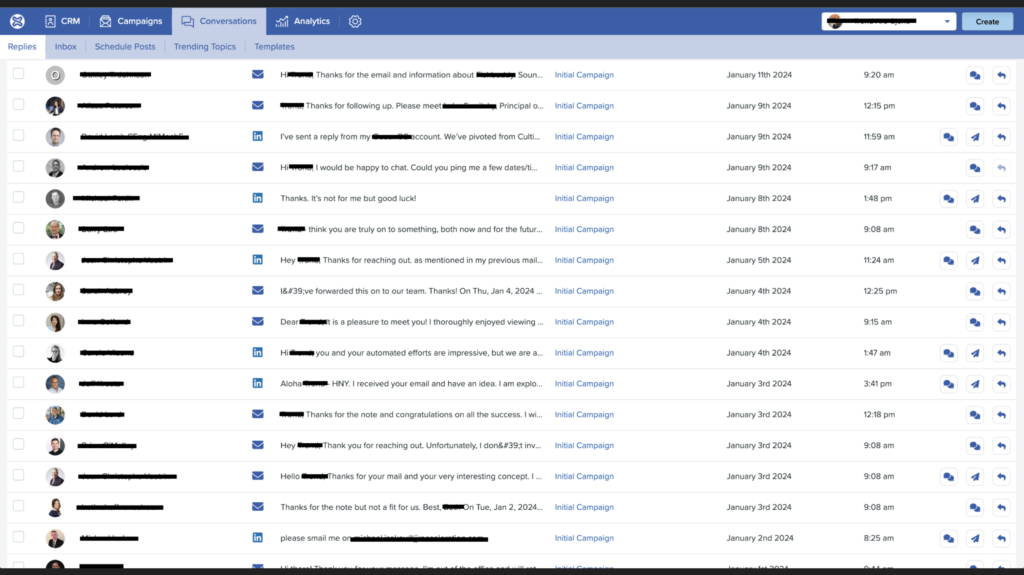

Step 3: Keeping Up With Investors

With the copy and the contacts situated. We need to start reaching out to investors. The most important thing to remember is we are looking to build meaningful relationships that lead into the delicate conversation that is fundraising.

To do this, we need to show our persistence, and be extremely responsive.

Having a dedicated data researcher to find investor leads and building compelling messages will get you a high chance of starting a conversation. But in order to make this process efficient and effective, we need to utilize a CRM to automate this and allow you to focus on what matters most, being the point of contact.

Having a streamlined automated system in place will allow you to constantly have a pipeline of investors with minimal effort on the outreach side while you can focus on making the most of each reply and engagement.

Fundraising is a delicate process so you need to have all your attention on building meaningful relationships.

Option 1: Do It Yourself

These are the three steps that we take to systemize our start-ups fundraising and get them to 5-7x their engagements with investors.

There are two ways to build out a system like this.

The first is to organize this yourself. These methods are all doable on your own and can be done by purchasing a CRM, hiring a copywriter, and getting a dedicated data researcher to collect investor leads.

In total this would only cost about $100/month for a good CRM, $400-500/month for a dedicated data researcher depending on where you hire, and $350+ for a copywriter with experience in fundraising.

This will ultimately save you thousands of dollars that would’ve been spent on an investor marketing agency or a broker that is going to give you a cookie cutter solution.

Option 2: Storm X

However, at Storm X, we provide a comprehensive solution to build this entire system for you without any hassle or unnecessary trial and error.

We have nailed down this strategy to be able to cater to start-ups from pharmaceutical all the way to hardware and food.

Again…

Again, this is for founders who are really trying to make an impact with their fundraising efforts and get a significant increase in engagement with qualified investors.

By working with us…

By working with us, you will have direct access to myself and my team of fundraising experts, copywriting and positioning, full access to our investor relations manager, and a dedicated data researcher to find investor leads.

Features

Our system includes

- Strategic Investor Relations Copywriting

- LinkedIn and Email Multi-Channel campaigns

- Email Warm up for deliverability

- 300-500 hand-picked investor contacts per month

- Access to virtual events with investors

- And full access to our comprehensive investor relations manager

Offer

We offer this entire solution for $500/month plus an onboarding fee for writing copy, building the campaigns, email warmup, and strategy.

So ultimately, if you want to make the most of your current fundraising round, I recommend finding higher quality investor leads whether that is hiring a data researcher or utilizing a company like Storm X.

Creating compelling copy that give the reader incentive to read and reply, not just a briefing of your company,

And a CRM to manage and stay as responsive as possible to build meaningful relationships that end in fundraising.